Your Home Sold Guaranteed, or I'll Buy It!*

Call George Lorimer and Start Packing at 619-846-1244

Get comps instantly at www.HomePriceSD.comIf you're wondering what's available for sale in your area, click here.

To get an Unlisted and Off-Market Home, here's how

*Conditions apply, ProWest Properties, DRE# 01146839. Below is a summary of the report. Our license allows us to send customers the full report. Click here.

San Diego County Housing Summary

- The active listing inventory in the past couple of weeks decreased by four homes, nearly unchanged, and now sits at 2,569. In January, 37% fewer homes came on the market compared to the 3-year average before COVID (2017 to 2019), 1,622 less. Last year, there were 2,382 homes on the market, 187 fewer homes, or 7% less. The 3-year average before COVID (2017 to 2019) was 5,469, or 113% extra, more than double.

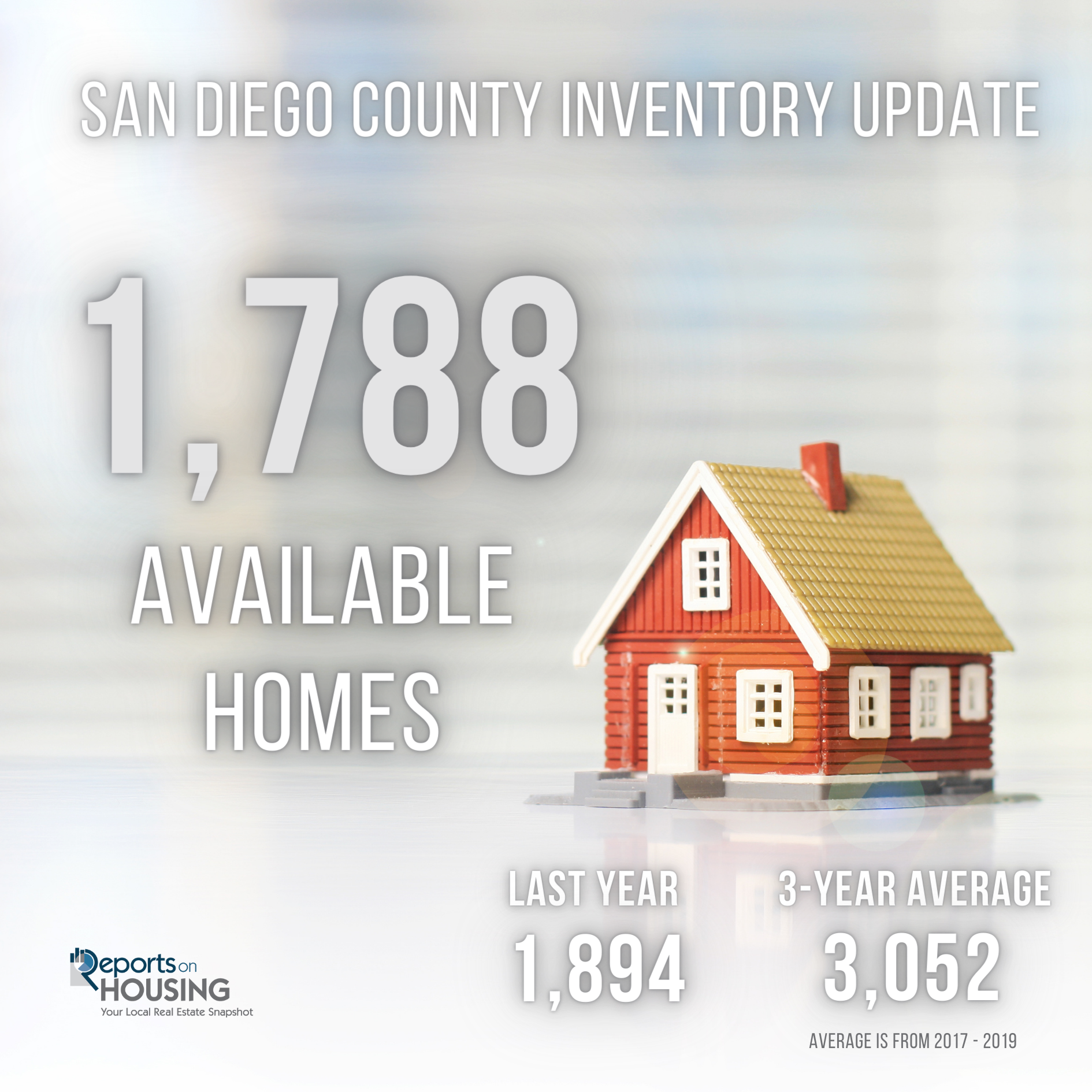

- Demand, the number of pending sales over the prior month, increased by 115 pending sales in the past two weeks, up 7%, and now totals 1,788, its lowest mid-February demand reading since tracking began in 2012. Last year, there were 1,894 pending sales, 6% more than today. The 3-year average before COVID (2017 to 2019) was 3,052, or 71% more.

- With demand increasing and a fractional dip in supply, the Expected Market Time, the number of days to sell all San Diego County listings at the current buying pace decreased from 46 to 43 days in the past couple of weeks. It was 38 days last year, slightly faster than today. The 3-year average before COVID (2017 to 2019) was 55 days, slower than today.

- For homes priced below $750,000, the Expected Market Time decreased from 41 to 37 days. This range represents 31% of the active inventory and 37% of demand.

- For homes priced between $750,000 and $1 million, the Expected Market Time decreased from 33 to 30 days. This range represents 20% of the active inventory and 28% of demand.

- For homes priced between $1 million and $1.25 million, the Expected Market Time increased from 31 to 41 days. This range represents 9% of the active inventory and 9% of demand.

- For homes priced between $1.25 million and $1.5 million, the Expected Market Time decreased from 53 to 42 days. This range represents 8% of the active inventory and 8% of demand.

- For homes priced between $1.5 million and $2 million, the Expected Market Time decreased from 66 to 53 days. This range represents 9% of the active inventory and 8% of demand.

- For homes priced between $2 million and $4 million, the Expected Market Time in the past two weeks remained unchanged at 72 days. For homes priced between $4 million and $6 million, the Expected Market Time in the past two weeks increased from 162 to 223 days. For homes priced above $6 million, the Expected Market Time decreased from 238 to 191 days.

- The luxury end, all homes above $2 million, account for 22% of the inventory and 10% of demand.

- Distressed homes, both short sales and foreclosures combined, comprised only 0.4% of all listings and 0.5% of demand. Only five foreclosures and six short sales are available today in San Diego County, with 11 total distressed homes on the active market, down one from two weeks ago. Last year, 16 distressed homes were on the market, slightly more than today.

- There were 1,432 closed residential resales in January, 3% more than January 2023’s 1,390 closed sales. January marked a 2% increase compared to December 2023. The sales-to-list price ratio was 98.6% for all of San Diego County. Foreclosures accounted for just 0.2% of all closed sales, and short sales accounted for 0.2%. That means that 99.6% of all sales were good ol’ fashioned sellers with equity.

Have a great week.

Sincerely,

Steven Thomas

Quantitative Economics and Decision Sciences

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !