In This Issue:

-

Why Schools And Amenities Matter Even If You Don’t Have Kids — How school quality and local amenities impact property value, buyer demand, and long-term resale potential for everyone.

Read More » -

How To Buy Your Dream Home Without Overpaying — Learn smart pricing research, strategic bidding, and how to win without blowing your budget.

Read More » -

Multiple Offers: How To Pick The Right One Not Just The Highest — Not all offers are created equal. Compare financing, contingencies, and timelines to choose the one most likely to close smoothly.

Read More »

Why Schools And Amenities Matter Even If You Don’t Have Kids

Summary

School quality and local amenities don’t just benefit families, they impact property value, buyer demand, and long-term resale potential for everyone. This report explains why these factors matter even if you don’t have kids, and how they shape both your lifestyle and investment. Whether you’re buying or selling, location decisions matter more than you think.

It’s common to assume that school districts and neighborhood amenities only matter to families with children. But in reality, these features affect every buyer and seller, because they influence demand, quality of life, and ultimately, property value.

Here’s how (and why) schools and amenities shape smart real estate decisions:

1. Schools Influence Property Value

1. Schools Influence Property Value

Homes in strong school zones tend to:

- Sell faster

- Retain value better during downturns

- Attract more offers

Even if you don’t plan to use the local school, buyers with children likely will and that demand drives price and competition.

2. Great Amenities Build DesirabilityProximity to walkable amenities, such as:

- Grocery stores and coffee shops

- Parks and recreational trails

- Transit stations and commuter access

- Restaurants and fitness centers

adds daily convenience and long-term appeal. The “15-minute neighborhood” concept is increasingly popular, especially with remote and hybrid workers.

3. Your Future Buyer May Care More Than You DoEven if schools or parks aren’t a priority for you today, the next person who buys your home may place them at the top of their list. Buying with resale in mind is a smart move, especially if you plan to sell in the next 5-10 years.

4. Walkability = Lifestyle + ValueBeing near amenities isn’t just about price, it’s about how you live. Shorter drives, more walkable errands, and better access to services all improve quality of life. And in many markets, walkability boosts demand and leads to higher property appreciation.

5. Better Neighborhoods Often Mean Better UpkeepAreas with strong schools and desirable amenities tend to have:

- Higher owner occupancy rates

- Better-maintained homes and landscaping

- More community involvement

These factors create a “halo effect” that benefits everyone.

6. Rentals and Investment Property ConsiderationsIf you’re buying to rent, school ratings and neighborhood features affect:

- Tenant pool

- Rentability

- Rental income stability

- Vacancy rate

Many renters will pay more to live near a good school, even if you wouldn’t.

7. How to Evaluate These Factors- School rating sites (GreatSchools, Fraser Institute, etc.)

- Municipal plans for new parks, transit, or shopping

- Drive time apps for commutes and accessibility

- Walk Score or Transit Score for lifestyle convenience

- Talk to neighbors or real estate agents for local insight

Buying in an area with weak schools or minimal infrastructure might:

- Limit your resale audience

- Cap appreciation potential

- Increase time on market when you sell

Unless you’re buying long-term or at a significant discount, these compromises could hurt your investment.

Conclusion:

Schools and amenities aren’t just nice-to-haves, they’re silent influencers of property value, buyer demand, and livability. Even if they don’t affect your lifestyle directly, they affect your real estate bottom line. Always consider what future buyers will value and position yourself for the best return.

How To Buy Your Dream Home Without Overpaying

Summary

In competitive markets, buyers often feel pressured to bid high, but that can lead to overpayment and financial stress. This guide walks you through smart pricing research, strategic bidding, and how to recognize when it’s time to walk away. With tips from real estate pros and negotiation experts, you’ll learn to win without blowing your budget. Perfect for buyers who want to be aggressive but still sensible.

Buying your dream home is one of life’s most rewarding experiences, but it can quickly turn sour if you overpay. In a competitive market, bidding wars and emotional attachment can cause buyers to stretch their budget too far. However, with careful planning and smart strategy, you can land the home you want, without spending more than you should. This guide outlines everything you need to know to buy wisely, avoid common pricing pitfalls, and keep your finances intact.

Understand the Market First

Understand the Market First

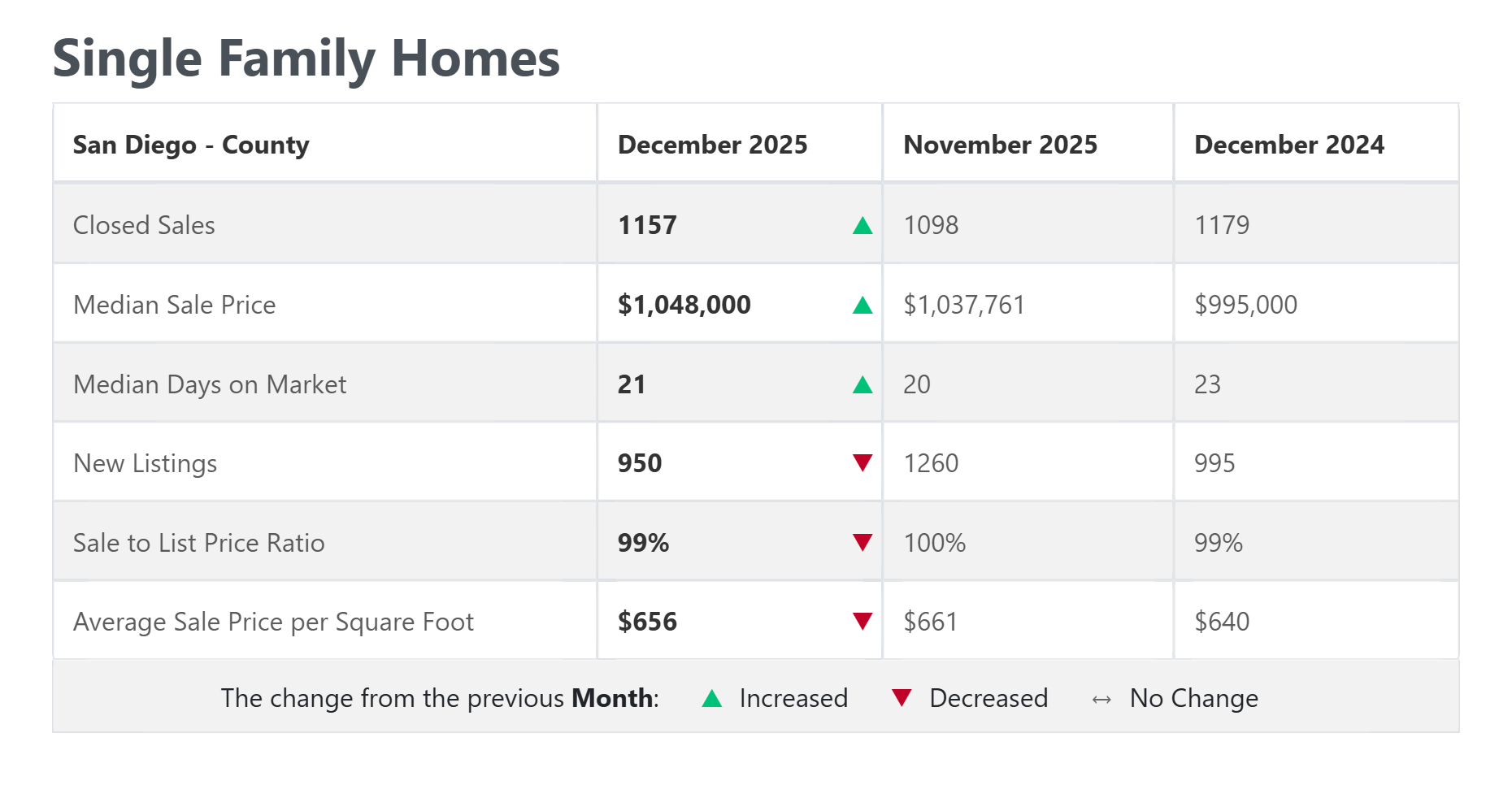

The foundation of a smart home purchase is understanding your market. Is it a buyer’s or seller’s market? What’s the average price per square foot in your area? Are homes typically selling above or below the asking price? Research recent comparable sales and days on market. Partner with an experienced agent who understands local trends and can help you interpret data. Going in blind is a recipe for emotional overbidding.

Get Pre-Approved, Not Just Pre-QualifiedPre-qualification gives you an estimate, but pre-approval shows sellers you’re serious and ready. A pre-approval letter also gives you a firm upper limit on your budget and helps prevent you from accidentally offering too much. Lenders will assess your credit, debt-to-income ratio, and employment status to determine what you can realistically afford. Use this number as your ceiling, not your target.

Know What the Home Is Really WorthJust because a home is listed at a certain price doesn’t mean it’s worth that amount. Look at comparable properties in the neighborhood. What did similar homes sell for recently? Are there any upgrades or features that justify a premium, or signs the home is overpriced? Pay attention to days on market and price reductions. If a house has been sitting for weeks in a hot market, the asking price may be too high.

Set a Firm Budget (and Stick to It)Before you make any offers, define your absolute maximum and decide under what conditions you’d walk away. Be disciplined, especially in emotionally charged multiple-offer situations. Include room in your budget for closing costs, immediate repairs, and post-move expenses like furniture or landscaping. Your dream home isn’t a dream if it puts you under financial strain.

Make a Smart Offer — Not Just the Highest OneYou can strengthen your offer in ways that don’t involve raising the price. A large earnest deposit, flexible closing date, and limited contingencies can all appeal to sellers. Work with your agent to craft a strong offer that balances competitiveness with financial protection. Sometimes a well-written offer with fewer conditions can beat a higher bid filled with contingencies.

Don’t Skip the Appraisal and InspectionAn appraisal ensures the home is worth what you’re paying. If it comes in low, you can renegotiate, or walk away. A thorough inspection reveals any structural or mechanical issues that could cost you later. Even in hot markets, waiving these protections is risky. If you must waive them to compete, consider doing an informational inspection post-closing or negotiating a shorter inspection window instead.

Control Your Emotions During NegotiationFalling in love with a home can cloud your judgment. Sellers (and even agents) can sense desperation and use it to their advantage. Remind yourself that there will always be another property and that buying the right home at the right price is better than rushing into one you can’t afford. Stay calm, deliberate, and data-driven.

Watch Out for Hidden CostsOverpaying isn’t just about the listing price. Property taxes, HOA fees, utility costs, insurance premiums, and maintenance add up. Research these numbers in advance. A home with a low sale price but high upkeep may ultimately cost more than a slightly more expensive one that’s efficient and low-maintenance.

Don’t Over-Renovate to CompensateIt’s tempting to overpay for a home that “needs work” with the plan to renovate. But major upgrades rarely return 100% of their cost. Make sure you’re not overestimating your ability or budget to transform a home. And don’t justify overpaying by thinking you’ll add value later. In most cases, you’ll only recoup a portion of what you invest.

Have an Exit StrategyBefore you buy, think about resale. Is this home likely to hold or increase in value over time? Are there factors that might make it hard to sell later, like a busy street, poor layout, or odd zoning? If market conditions change and you need to move within a few years, can you rent it out or break even? Buying smart also means planning for the long term.

Your dream home should bring you joy, not financial stress. With discipline, research, and strategic negotiation, you can buy confidently and stay within your means. It’s possible to win in today’s market without sacrificing your financial future. Remember: the goal isn’t just to buy a home, it’s to make a smart investment in your life.

Multiple Offers: How To Pick The Right One Not Just The Highest

Summary

In a hot market, sellers often receive multiple offers. While it’s tempting to choose the highest price, not all offers are created equal. This report helps you evaluate every part of an offer, from financing strength to closing flexibility, to ensure you pick the one that’s most likely to close smoothly and leave you satisfied. Learn how to compare, negotiate, and choose wisely.

Receiving multiple offers can feel like a dream come true, but it can also be overwhelming. Choosing the highest offer might seem obvious, but the smartest sellers look beyond price to evaluate the full picture. A slightly lower offer with better terms can sometimes be the safer, more profitable path. Here’s how to compare and choose offers with confidence.

- Look at Financing Type

- Cash Offers: These typically close faster and have fewer risks (no appraisal or loan approval delays).

- Conventional Loans: Strong, especially with large down payments.

- FHA/VA Loans: May require more stringent appraisals or repairs.

Ask to see a pre-approval letter or proof of funds to confirm the buyer’s financial strength.

- Review the Contingencies

Contingencies give buyers legal outs, but too many create uncertainty for you. Common contingencies include:- Financing: Standard, but risky if the buyer is only marginally qualified.

- Appraisal: May trigger price negotiations if the home appraises low.

- Inspection: Allows buyers to back out or request repairs.

- Home sale: Risky, ties your sale to another closing.

Fewer contingencies equals a stronger, cleaner offer.

- Consider the Closing Timeline

A quick close may be ideal if you’re ready to move. A longer close might be better if you need time to find your next home. Flexibility matters—offers that match your preferred timeline are often more attractive.

- Compare Earnest Money Deposits

Earnest money shows the buyer’s seriousness. Larger deposits reduce your risk. Typical ranges are 1–3% of the offer price.

- Understand Buyer Motivation

Buyers relocating, with deadlines or emotional attachment, may be more committed. Others just “testing the market” may be more likely to walk away.

- Beware of Escalation Clauses

Some buyers include clauses that automatically increase their offer above the highest bid. These can be tricky to navigate. Always confirm the buyer’s price ceiling and review how the clause is structured.

- Check Offer Expiration Dates

Some offers are only good for 24–48 hours. Don’t let a deadline force a rushed decision, but be mindful that delays could cause a buyer to walk away.

- Don't Forget About Personal Letters

While not always effective or appropriate, some buyers submit “love letters” with their offers. These can help humanize a buyer and provide insight into their motivation, though fair housing laws limit what can be considered.

- Ask Your Agent for a Net Sheet

Your agent can provide a side-by-side breakdown showing what you’ll actually walk away with from each offer. This includes price, concessions, and estimated costs. -

Don’t Be Afraid to Counter or Ask Questions

If you like parts of multiple offers, your agent can help you counter or ask for clarifications. You’re not locked in until you sign.

Conclusion:

Getting multiple offers is a good problem, but it’s still a problem to solve. Look beyond just price and evaluate the full offer package: financing, contingencies, flexibility, and likelihood of closing. The best offer is the one that gets you to the finish line with the fewest headaches and the most money in your pocket.

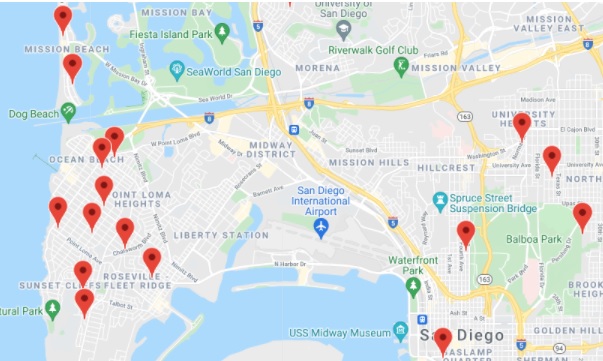

San Diego more homes, better deals, see this weekend?

|

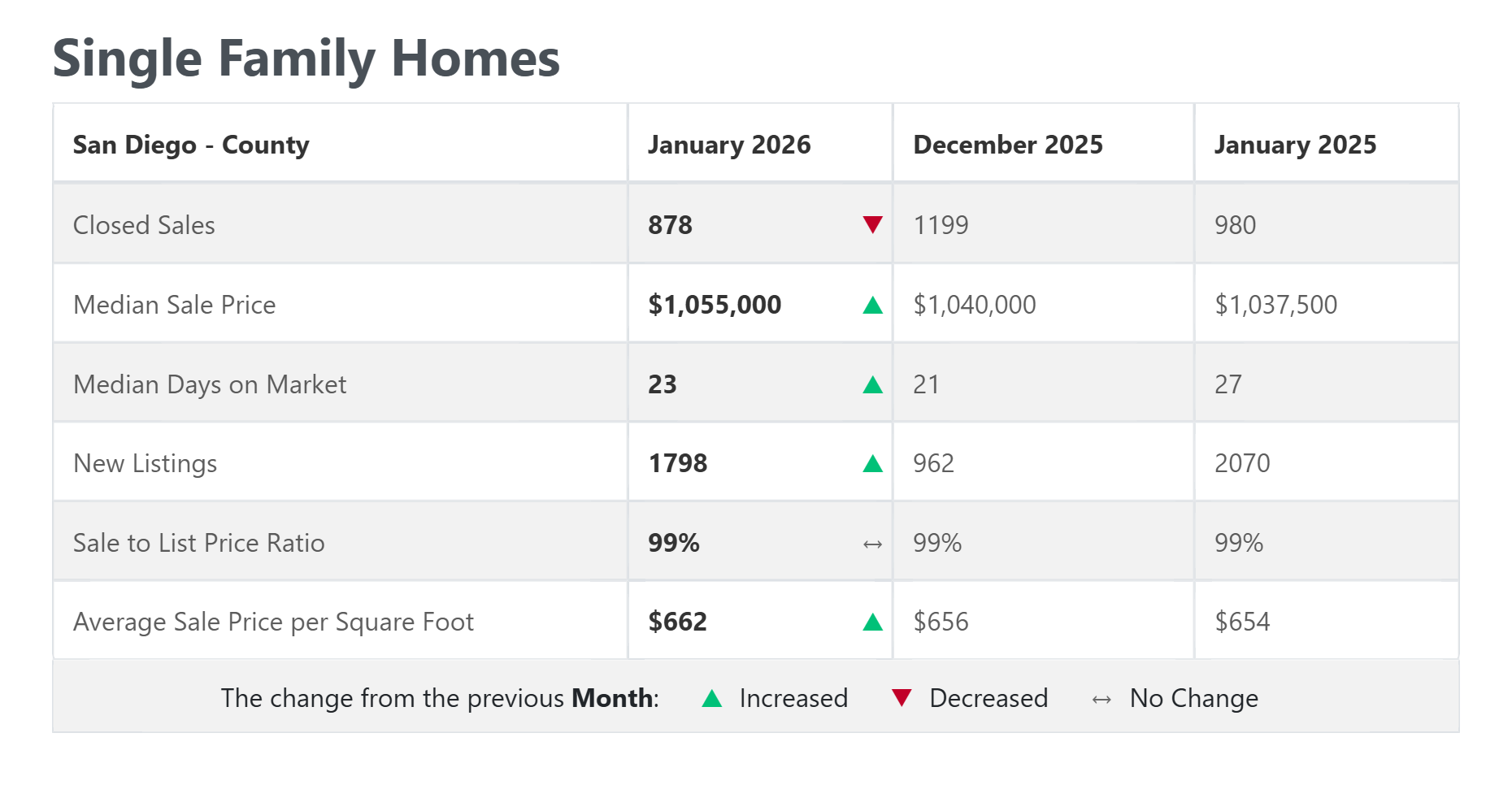

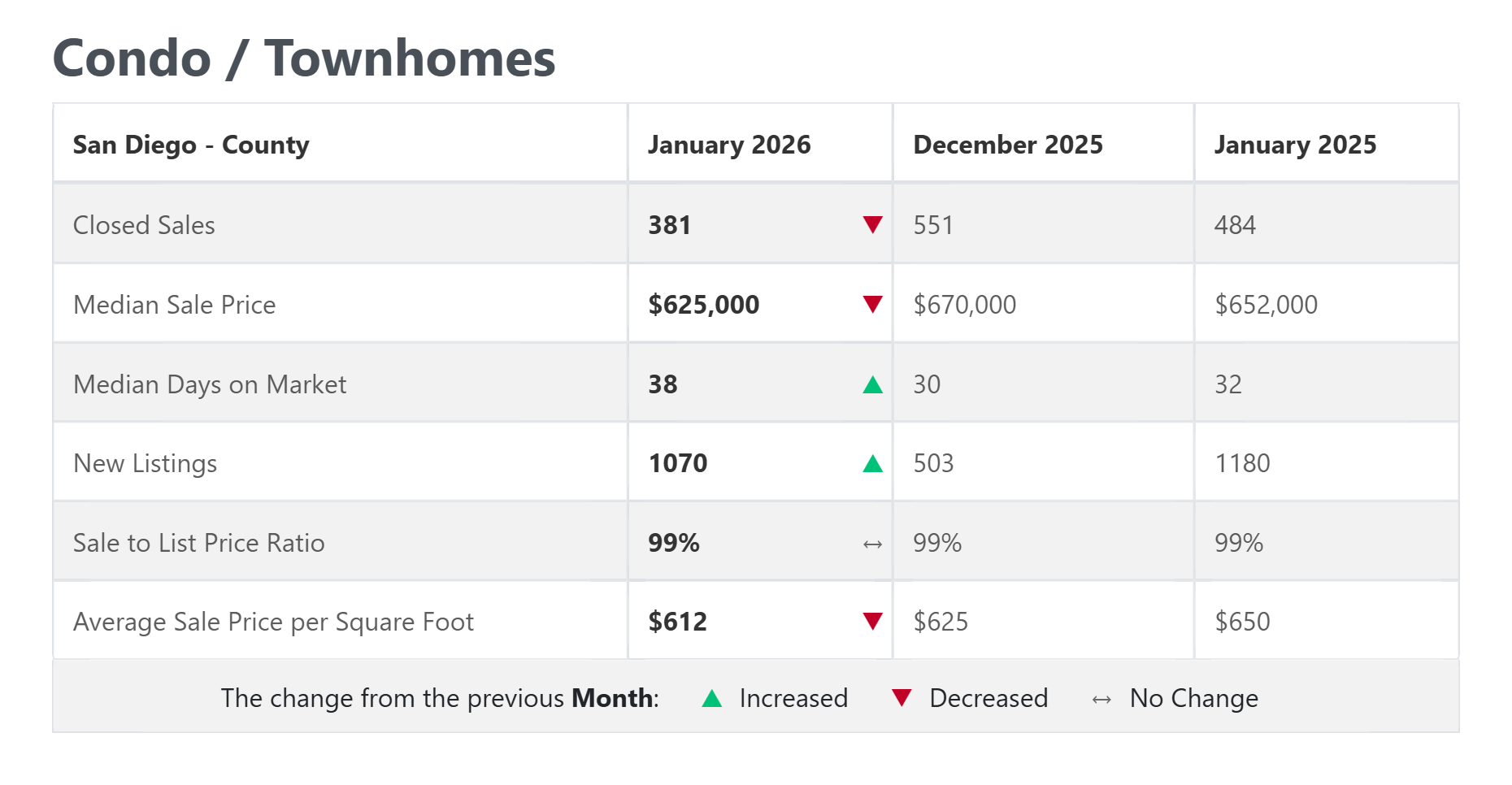

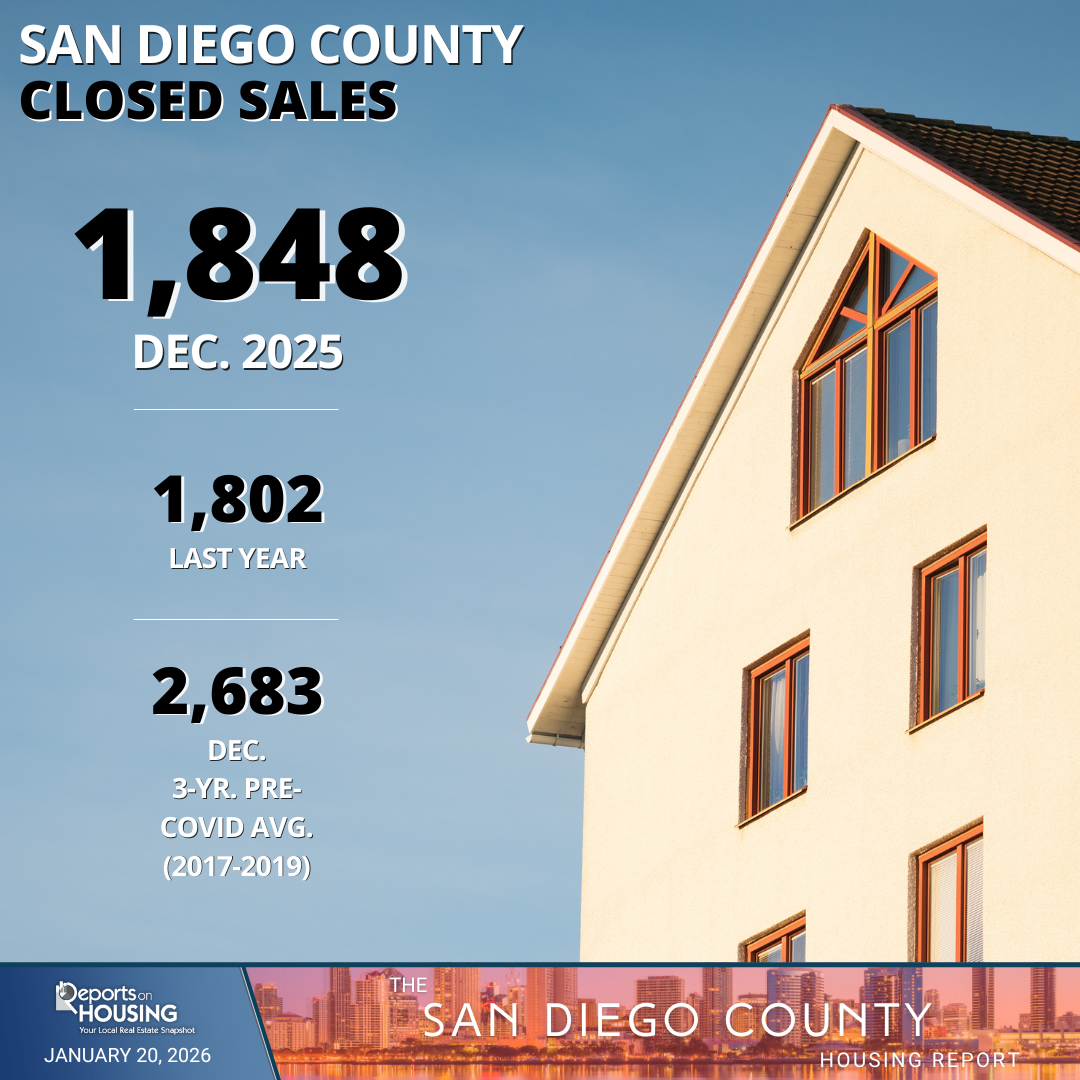

What San Diego Housing Slowdown?

|

What Would Have to Happen for San Diego Prices to Crash?

|

Is Your San Diego Neighborhood Hot or Cold in 2026?

|

1,400 Homes Are Selling Every Month in San Diego — Is Yours One of Them?

|

San Diego Homes Are Moving Faster in 2026 (And Here’s Where Demand Is Hottest)

|

Spring Has Already Started in San Diego (Most People Miss This)

|

How do people afford San Diego homes

|

In 2026, Smart San Diegans Don’t Just Look at Prices — They Look at Timing & Options

|

San Diego Real Estate Opportunities Happening Now (Open House + 2–4 Unit Deals)

|

Why 1 in 3 San Diego homes do not sell and what to do about it. Expired listing.

|

San Diego Winter Market Is Here: Prepare for Launch (What Buyers & Sellers Should Do Now)

|

San Diego Housing Market Heating Up This January: Why Smart Buyers and Sellers Are Moving Now

|

Open House Downtown San Diego

|

San Diego Housing Market: Which Neighborhoods Are Hot — and Which Are Cooling in 2026

|

What 6% Rates Mean for Buyers & Sellers

|

2026 San Diego Housing What Buyers and Sellers are Doing

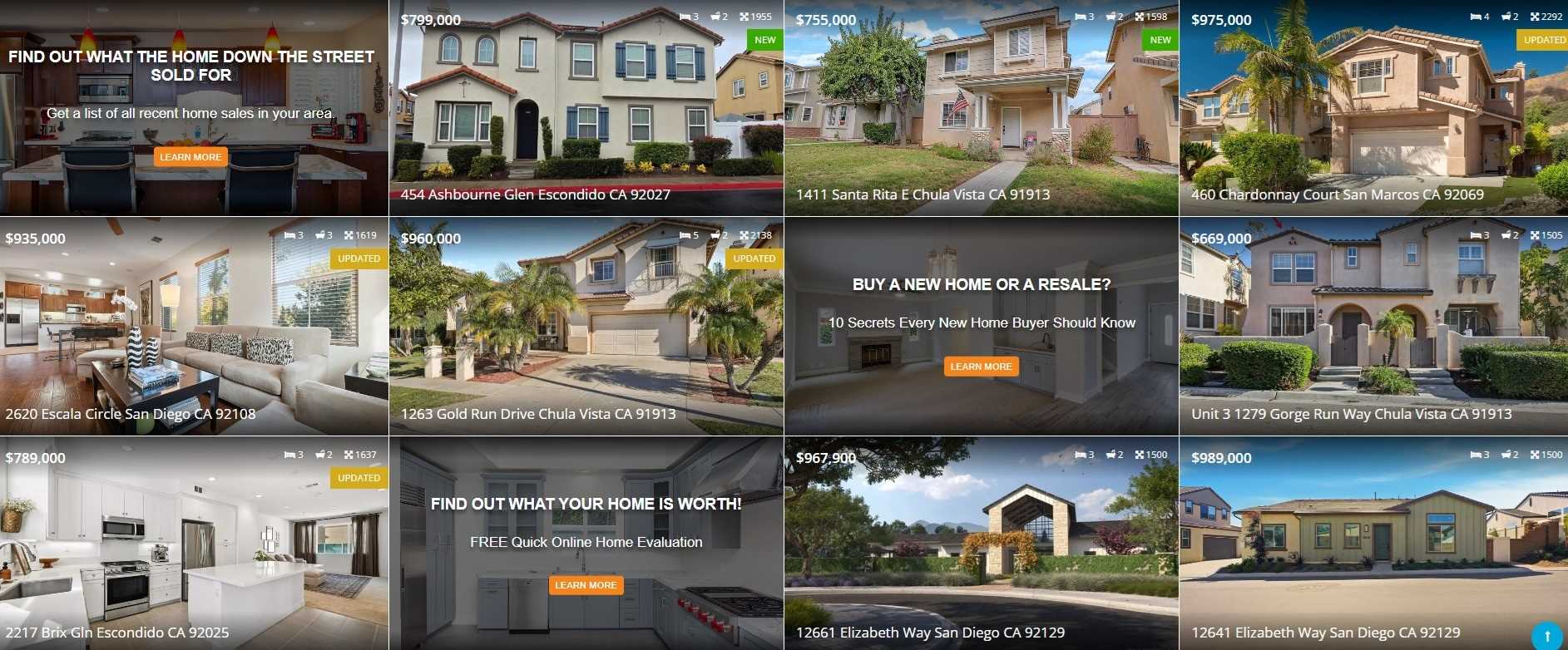

If buying or selling a home in San Diego is even on your radar in 2026, here’s the honest update I’m seeing every day — not the headlines. Buyers want lower mortgage rates, fewer bidding wars, and homes that actually feel like good deals. Sellers want to know if now is the window to sell before more inventory shows up. Here’s the truth: there is no perfect rate and no perfect year. The people who win are the ones who move with a plan — not hope. Online estimates miss what actually drives value in San Diego — condition, layout, upgrades, views, and micro-location. Homes on the same street can vary by hundreds of thousands of dollars. If you want real numbers — or a clear buy or sell plan for 2026 — call or text me directly at 619-846-1244. Helpful resources: P.S. The biggest mistake I’m seeing in 2026 is people waiting for “better conditions” that may never line up. If you want to see what’s actually available right now — including homes not on Zillow — start here before competition picks up.

|

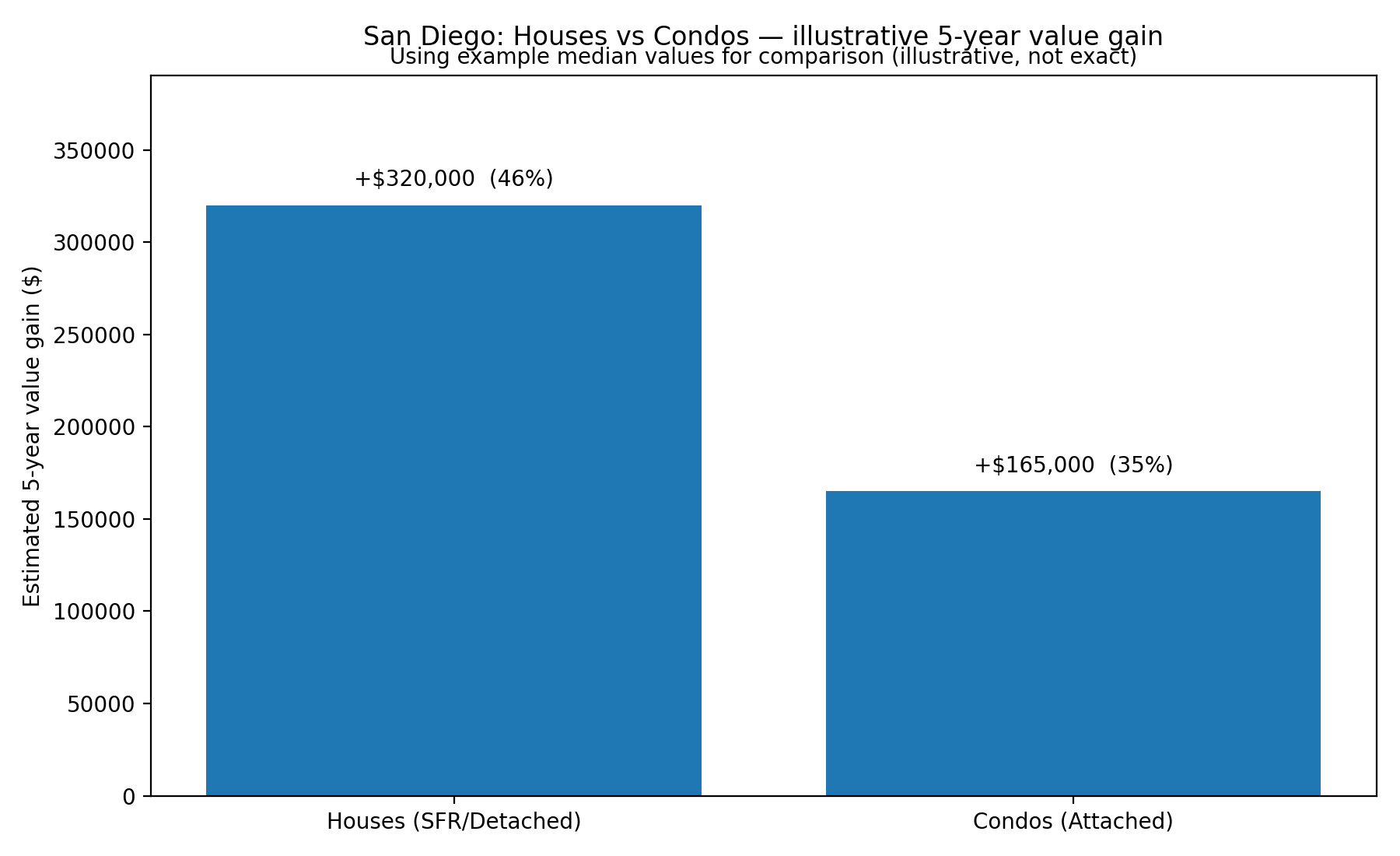

Houses vs. Condos in San Diego: Which Has Been the Better Investment (Last 5 Years)?

|

2026-san-diego-home-buyers-sellers-frustrated

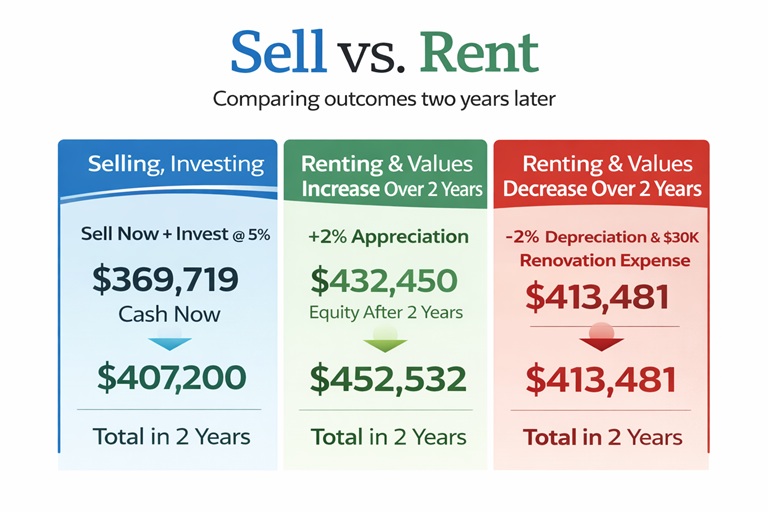

Buyers want prices to come down. Sellers want prices to go up. Everyone wants mortgage rates under 6%. Sound familiar? Here’s the part that actually matters: mortgage rates are about 1% lower than last year, and that’s already changing what’s possible—especially for buyers under $1 million. Start here (most popular right now): See what’s available under $1M in San Diego This isn’t headlines or predictions—I’m seeing this daily in real contracts. Some buyers are getting options and leverage again, but only if they know where to look. If selling is even a possibility, the smartest first step is real numbers—not guesses from Zillow. You can see your true value and cash-offer options here: Value and Cash Offers. Waiting for “perfect” usually costs more than moving forward with a plan. If you want help sorting this out quickly, call or text me at 619-846-1244. I’ll give you straight answers and real options. George Lorimer Your Home Sold Guaranteed, or I’ll Buy It* *Conditions apply, ProWest Properties, DRE #01146839?

|

Surprising San Diego Home Trends I See in Person, Not on Zillow

|

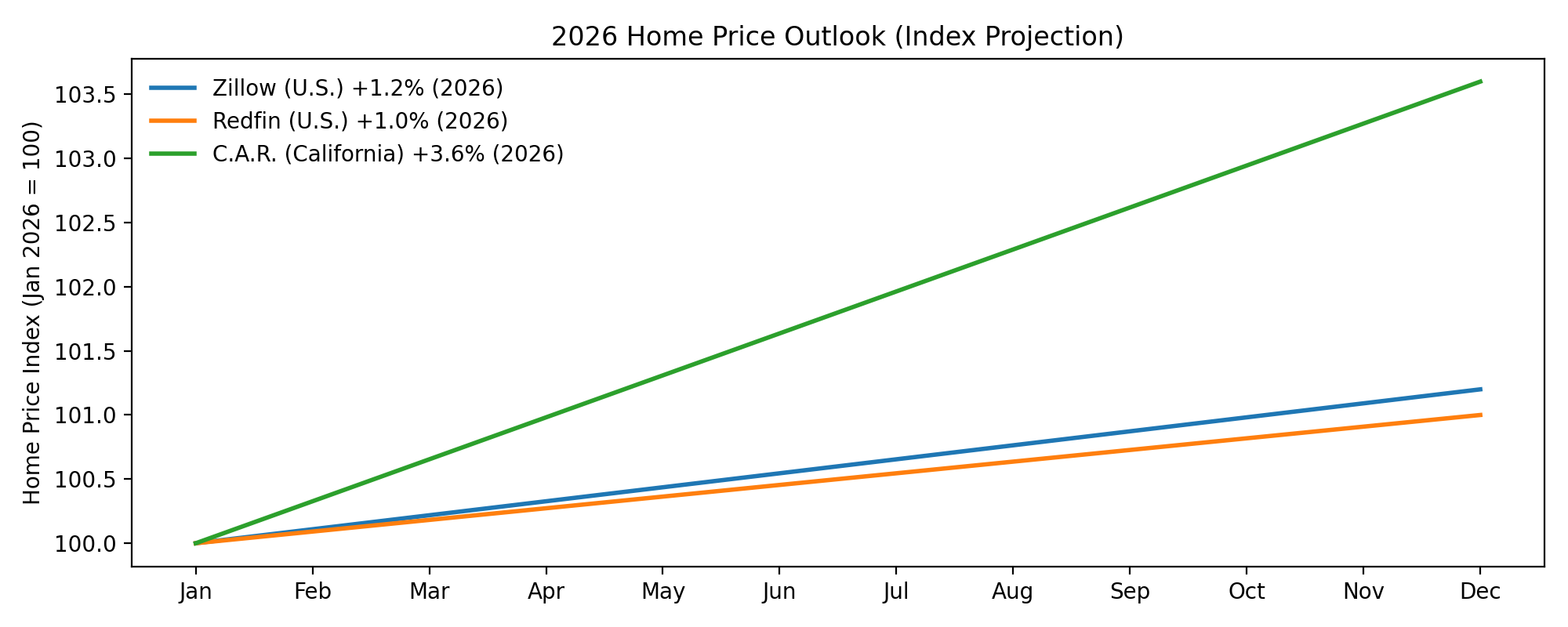

2026 San Diego Housing Outlook — What Buyers and Sellers Should Know Now

|

Rancho Peñasquitos & Torrey Highlands Homes 92129 Homes

Fast market snapshot (last 6 months as of Dec 19, 2025). If you want the full spreadsheet (every address + list/sold history), text “92129 DATA” to 619-846-1244. Most Torrey Highlands & newer RP sellers focus here (last 6 months). Want model-by-model detail? Text “92129 DATA” to 619-846-1244. Rancho Peñasquitos overall — sold last 6 months. Thinking of selling? Text your address & timeline to 619-846-1244. Source: SDMLS / ShowingTime ProWest Properties • DRE #01146839 • Your Home Sold Guaranteed or I’ll Buy It* • *Conditions apply I’ve lived and worked in San Diego for over 20 years, helping homeowners make smart decisions about when to sell, when to wait, and how to maximize value without pressure. Real estate is personal — that’s how I treat it. George Lorimer • ProWest Properties • DRE #01146839

|

San Diego home and short sales

|

San Diego’s Best “Quiet Window” to Plan a 2026 Move (Free 10-Minute Strategy Call)

|

How Long Does It Take to Sell a San Diego Home?

If you’re thinking about selling in 2026, here’s the truth: you don’t have to rush out after you sell. You can sell now and move later with a rent-back, or sell very fast if timing matters. Timeline example used below starts January 10, 2026. Your exact timing depends on pricing, condition, neighborhood, and strategy. You get paid first and move later — ideal if you’re finishing the school year or planning a summer move. Single-family homes typically sell faster than condos. Downtown and HOA-heavy condos often take longer, while well-priced houses in strong school districts move quicker. Want a clear plan for your timeline? George Lorimer • ProWest Properties • DRE #01146839

|

Buy a San Diego Home With an Under-6% Mortgage — Guaranteed

The Fed cut rates by 0.25% on December 10, 2025. Good news — but mortgage rates don’t drop automatically. They’re driven by the bond market. The smart move is learning how to secure the lowest rate available right now through negotiation. Call or text 619-846-1244 for a 10-minute strategy call. Want a free, customized report based on your price range and off-market homes? Call or text George at 619-846-1244. 30-year fixed rates are hovering in the low-6% range. FHA and VA can be lower. Sub-6% is achievable when offers are structured correctly. How do you guarantee an under-6% mortgage? I negotiate it with the seller as part of your offer. If they don’t accept it, my lender and I pay the loan discount so you still get the lower rate. Simple — just work with us on your purchase. George Lorimer • 619-846-1244 George Lorimer • ProWest Properties • DRE #01146839

|

San Diego 4-Step Plan to Buy or Sell a Home Without Stress

Most people don’t need more “advice.” They need a simple plan that reduces risk, prevents surprises, and gets them to the finish line. Here’s the exact 4-step process my team uses to help buyers and sellers move fast, stay protected, and avoid drama. Prefer a quick call? Call/Text George Lorimer at 619-846-1244 for a 10-minute strategy session. If the video doesn’t load, view it here: https://www.youtube.com/shorts/AuwjkgTXOxw?feature=share Buyers worry about overpaying or missing out. Sellers worry about pricing wrong, getting lowballed, dealing with repairs and showings, or buying the next home before the current one sells. The solution isn’t hope — it’s a clear process that removes risk. We start with clarity: updated home value, realistic net, buying power, neighborhoods, and what homes are actually available (including unlisted opportunities). This is where you stop spinning and start making smart moves. Most people only see one path: list it and hope, or buy and compete. We lay out multiple paths so you can choose what fits you: cash offer options, multiple investor offers competing, buy-before-you-sell solutions, and the right timing strategy for your goals. Once you choose the best path, my team handles the details: pricing, prep guidance, marketing, negotiation, inspections, and timelines — with one goal: get you the result you want with the least stress and the least wasted time. This is where most agents disappear — and where we do the opposite. We troubleshoot, protect your deal, and keep you informed. If plans change or something comes up, you’ve got an experienced team and real safeguards behind you. Bottom line: I have your back. If you’re thinking about buying or selling in the next 30–90 days, don’t wing it. Get the numbers and your best options first. George Lorimer • ProWest Properties • DRE #01146839

|

Meet George Lorimer San Diego broker and realtor

|

How to avoid the first mistake that San Diego home sellers makeIf you’ve been wondering what's going on in the San Diego housing market, here’s a quick reality check: The reason I tell you this is that there's an opportunity to buy at a good deal in this market. And if you're thinking of selling, don't price your home speculatively. For example, these speculative sellers say things like, "If I could get this price, I'd sell." (usually "their price" is higher than today's market value). For buyers, it becomes clear that the price may or may not have been based on today's statistics. For sellers, it's evident that unless you price it right, you may not sell. Here's my simple 3-step strategy that's helped over 1,000 sellers. 1) Determine that you are committed to selling. 2) Then price your home against competing listings, the homes buyers are comparing yours to. 3) Listen to feedback from the market and buyers and implement changes. Do this right, and you create urgency, competition, and the best chance of selling for top dollar. Call or text me, George, at 619-846-1244 to get your Complimentary Home Seller Report. All the best, George Lorimer Secret selling options that other agents don't offer.

|

San Diego County Housing Report: Go for Gold, No Waiting

|