Notice 2020-23 (which updates Notice 2020-18, “Additional Relief for Taxpayers Affected by Ongoing Coronavirus Disease 2019 Pandemic”), released on April 9, 2020, provides Taxpayers who are currently engaged in a 1031 exchange some relief from the 45-Day Identification and 180-Day Exchange Period deadlines.

The notice provides that any person performing a time-sensitive action listed in either § 301.7508A-1(c)(1)(iv) – (vi) of the Procedure and Administration Regulations or Revenue Procedure 2018-58, 2018-50 IRB 990 (December 10, 2018), which is due to be performed on or after April 1, 2020, and before July 15, 2020 (Specified Time-Sensitive Action), is an Affected Taxpayer.

Section C of the Notice states that “Affected Taxpayers also have until July 15, 2020, to perform all Specified Time-Sensitive Actions, that are due to be performed on or after April 1, 2020, and before July 15, 2020.”

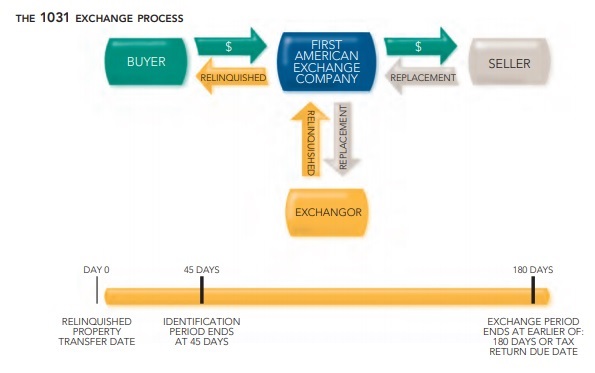

This appears to provide that any Affected Taxpayer with a 45-Day Exchange Period or 180-Day Exchange Period deadline between April 1 and July 15, 2020, will have an automatic extension to July 15, 2020.

Examples:

1) If your identification period falls between 4/1/2020 and 7/15/2020 you have until 7/15/2020 to identify prospective replacement properties.

2) If your 180 deadline falls between 4/1/2020 and 7/15/2020 you have until 7/15/2020 to complete your exchange transaction.

We will continue to monitor any new guidance from the IRS and inform you of any changes that might affect your 1031 exchange.

This notice is not intended to serve as legal or tax advice. Please consult with your tax or legal advisor regarding your specific circumstances. |

|