------ NO ------

October 3, 2023, San Diego County Housing Report: Sluggish, Yet No Slide Ahead

With sky-high rates and a collapse in home affordability, many wrongly conclude that there will be a wave of foreclosures, and it is just a matter of time before the housing market crashes.

Your Home Sold Guaranteed, or I'll Buy It!*

Call George Lorimer to discuss the sale of your home at 619-846-1244

No Distress and No Crash in Housing

Collectively, homeowners across the U.S. are healthier than ever before, which will prevent distressed sales and a housing crash. Download your free copy of the full report.

Fear. Worry. Uncertainty. These words describe how many people feel about today’s housing market. Home values surged higher since 2022, and within the past couple of weeks, mortgage rates have climbed to heights not seen in 23 years. With home affordability at record lows, many argue that when the economy cools or slips into a recession, housing will collapse, and foreclosures will rise. After all, isn’t that how the Great Recession unfolded?

The general public often jumps to conclusions without looking at all the facts and trend lines. They remember the burn from 2008 through 2011. Everybody was burned or knew someone hurt by the collapse in home values. The economy ground to a halt, and unemployment grew to levels last seen at the beginning of the 1980s. Thus, everyone is jumping to the worst-case scenario in their collective minds: housing must suffer.

It is imperative to immediately point out that just because mortgage rates have climbed towards 8% does not mean that values must go down, and many homeowners will lose their homes due to foreclosures or short sales. The Great Recession was fueled by a credit bubble inflated by loose lending standards, including subprime mortgages, pick-a-payment plans, teaser adjustable rates, zero down, and plenty of fraud. These high-risk borrowers were susceptible to any adjustments in their rates or changes to the economy. Thus, a wave of foreclosures ensued.

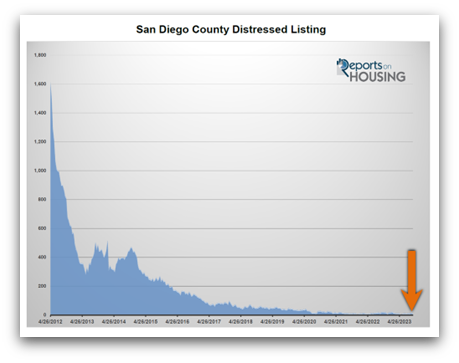

Today, only three foreclosures and seven short sales are available to purchase in San Diego County; that is only ten total distressed listings. Distressed demand, the number of new pending sales over the prior month, is at seven. Foreclosures and short sales represent only 0.4% of the active listing inventory and 0.4% of overall demand. Compare that to April 2012, right after the end of the Great Recession, when there were 1,613 distressed listings, 23% of the inventory, and distressed demand was at 2,945 pending, 56% of total demand.

October 3, 2023, San Diego County Housing Report: Sluggish, Yet No Slide Ahead

With sky-high rates and a collapse in home affordability, many wrongly conclude that there will be a wave of foreclosures, and it is just a matter of time before the housing market crashes.

Call George Lorimer to discuss the sale of your home at 619-846-1244

No Distress and No Crash in Housing

Collectively, homeowners across the U.S. are healthier than ever before, which will prevent distressed sales and a housing crash. Download your free copy of the full report.

Fear. Worry. Uncertainty. These words describe how many people feel about today’s housing market. Home values surged higher since 2022, and within the past couple of weeks, mortgage rates have climbed to heights not seen in 23 years. With home affordability at record lows, many argue that when the economy cools or slips into a recession, housing will collapse, and foreclosures will rise. After all, isn’t that how the Great Recession unfolded?

The general public often jumps to conclusions without looking at all the facts and trend lines. They remember the burn from 2008 through 2011. Everybody was burned or knew someone hurt by the collapse in home values. The economy ground to a halt, and unemployment grew to levels last seen at the beginning of the 1980s. Thus, everyone is jumping to the worst-case scenario in their collective minds: housing must suffer.

It is imperative to immediately point out that just because mortgage rates have climbed towards 8% does not mean that values must go down, and many homeowners will lose their homes due to foreclosures or short sales. The Great Recession was fueled by a credit bubble inflated by loose lending standards, including subprime mortgages, pick-a-payment plans, teaser adjustable rates, zero down, and plenty of fraud. These high-risk borrowers were susceptible to any adjustments in their rates or changes to the economy. Thus, a wave of foreclosures ensued.

Today, only three foreclosures and seven short sales are available to purchase in San Diego County; that is only ten total distressed listings. Distressed demand, the number of new pending sales over the prior month, is at seven. Foreclosures and short sales represent only 0.4% of the active listing inventory and 0.4% of overall demand. Compare that to April 2012, right after the end of the Great Recession, when there were 1,613 distressed listings, 23% of the inventory, and distressed demand was at 2,945 pending, 56% of total demand.

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !